How Sophisticated Should Your Investment Tools Be?

If you are a day trader or an active investor you probably don’t need to read this article. Seriously, you probably use a lot of software gadgets on some electronic trading dashboard that shows you the markets you are interested in, tracks stocks and commodities, and helps you set your limits. You’re set. Go make your millions of dollars.

If you are a day trader or an active investor you probably don’t need to read this article. Seriously, you probably use a lot of software gadgets on some electronic trading dashboard that shows you the markets you are interested in, tracks stocks and commodities, and helps you set your limits. You’re set. Go make your millions of dollars.

As for the rest of us, let’s face it: we are terrible at analyzing markets, market trends, and figuring out where to put our money. If you dream of being like Warren Buffett you are probably many billions of dollars in value short of realizing that dream. But though we cannot be like Warren Buffett we may still be able to benefit from his wisdom. In 2013 in his annual letter to Berkshire Hathaway investors Mr. Buffett outlined the instructions he was leaving in his will for the executor of his estate: put 90% of the money into an index fund. You have to wonder what will happen to Berkshire Hathaway share prices once Mr. Buffett has passed on.

Meanwhile, index fund managers are reaping the windfall publicity as thousands of investment blogs have been debating this strategy for over a year. There is really not much new to say, if anything at all. Some people agree with the strategy and some people do not. Naturally those who do not include among their ranks many investment fund managers, financial advisers, and other members of the investing industry who earn their livings from the fees that investors pay on trades. But let’s not waste energy on dramatizing the debate.

Suppose you really just want to follow Warren Buffett’s “set it and forget it” advice? How do you do that? Is it as simple as signing up with E*Trade or Charles Schwab and steer to the nearest Exchange Trade Fund (ETF for short)? Maybe. But investors learn to be suspicious by nature about everything, including where they execute their trades. All stock brokers are regulated and have to meet certain requirements but they also seek to differentiate themselves from each other.

You can certainly look for online reviews of the various brokerages. There are consumer Websites like Yelp but you may prefer some of the investment sites that publish broker reviews. Assuming these guys are not breaking any laws they may be giving you balanced reviews of the brokers’ services and software. But ultimately you have to decide for yourself if you like the service.

To set up an autopilot investment strategy you want to use an exchange traded fund offered by brokers like Tradestation. These are the index funds that everyone is talking about (technically, any mutual fund acts like an index fund by tracking a small group of stocks). The index funds almost everyone favors are based on the Standard & Poor 500. All the major brokerages offer these funds. There is no single S&P 500 fund.

Because the funds are managed by automation they charge relatively low fees for participation. That is always a good thing. But if you’re hoping to grow rich by investing in an S&P 500 fund then you may be missing the point of Mr. Buffett’s strategy. As the market (and economy) goes, so goes the S&P 500. Your growth occurs over years, not overnight. Many investors become impatient at the slow growth. Worse, they may panic when the next economic downturn hits the market because the S&P 500 index fund prices plummet (although this is actually the best time to invest in such a fund).

So you have to ask yourself, if this is really all I want to do, then do I need all the dashboards and analytical tools? After all, timing the market is very, very difficult to do and if you are banking on the S&P 500 growth over the next 10 years your best strategy is to just keep making regular contributions.

But you could, if you really wanted to maximize this strategy, run dual investment plans. Your predictive tools may give you an indication of when the next big economic downturn could start (no one can predict these things exactly). You might time the movement of some money so that you have more available to invest at that time. You cannot use past market performance to predict when the next recession will hit.

Instead, you have to look at what is affecting the economy at large, such as the creation of jobs (or the destruction of jobs) and changes in consumer spending patterns. A recent economic prediction suggests a massive drop over the next few years in cashier jobs across the United States of America. You don’t think of cashiers as high-value consumers but there are millions of them, many of whom are partners in two-income families.

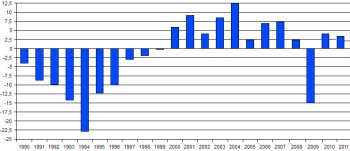

The loss of millions of low-paying jobs could lead to exactly the kind of economic downturn we faced from 2007-20010. Although this loss of jobs will be gradual as automation takes over at the cash register, we have to ask what these people will do to replace their incomes. If most of them succeed in finding other jobs things should be okay. We need to look at other aging industries to see which ones are threatened by technology and overseas competition.

But we’re also facing slowed growth in the American economy this year. Economists and investors alike are worried that the millions of low-quality jobs that have been created since the Great Recession have not replaced the incomes that were lost. Business are faced with widespread demands for raising the minimum wage, and some states and cities have enacted new minimum wage laws that override the outdated Federal standards. But business owners are threatening to fire or lay off employees in order to compensate for the increased wages they pay to others.

If raising the minimum wage does not produce a net increase in consumer income and spending then the economy will continue to lumber along at suboptimal growth. Eventually the stock markets will lose their momentum and investors will begin to doubt the prospects for the immediate future. The correlation between stock market performance and economic activity is well-documented, and though there is no investor who sits around thinking, “Well, I guess we’ll be in a recession in six months so I better selling my stocks” the complicated reality is that investors make calculated decisions to dump stocks on companies who immediate profitability is threatened by adverse business conditions.

When you pile up enough adverse business conditions a lot of companies start hedging their bets in their quarterly earnings reports, and these bad reports lead investors to dump their stocks. So while there is no magic economic indicators dashboard you could, hypothetically, monitor quarterly earnings and how investors react to them. That way you may see a small (or large) downturn coming in 3-6 months, which would be the ideal time to start increasing your investment in the S&P 500 index fund of your choice.

Because if there is one thing we know, it is that sooner or later the S&P 500 will bounce back regardless of how many companies go out of business.