-

How do You Use Float to Make Money?

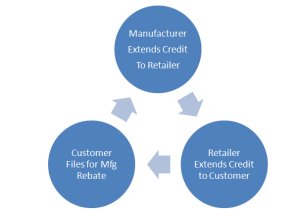

“Float” is a financial concept that has been used in both personal and business accounting for a long, long time. In simple terms float is the temporary double use of an asset or valuation, including money. The most common example used to explain float involves writing a check. On Friday you write a check for $100 to Sam. The $100 is in your account. On Saturday Sam deposits the check in his account. Even by today’s lightning-swift banking processes, Sam’s bank probably won’t receive the money for the check from your bank until Monday or Tuesday. So from Saturday until whenever your account is debited for $100 that money “exists”…

-

How do you Rate Investing Advice from Investing Publicity?

Financial services companies publish press releases at a prodigious rate. Many of these releases are required by law to inform corporate investors and prospective investors of the business facts or to announce new products and services to the public. Lawfully-driven press articles are usually very bland, very boring. They are loaded with disclaimers and make no promises. Promotional press releases, however, are very different in nature. They tout the goals behind the programs, selling dreams (that have a fair chance of realization). But the question of reliability should occur to everyone who reads these press releases. How reliable is the information you’re being given? It is, of course, factually correct…

-

The Biggest Mistake I Ever Made With a Credit Card

Like millions of other people I use credit cards from time to time to finance big expenses. But a few years ago I found myself in a real spot and I thought at the time that my credit cards would be a good solution for me. Unfortunately, I didn’t realize until too late that banks are not my friend. What happened? I lost my job. Fortunately I had set back a little bit of money and I was able to use that to stay afloat while I looked for new work. But I also had a couple of credit cards with charges on them. I made regular monthly payments on…

-

What Your Insurance Agent Wants You to Know About…Insurance

We all eventually come around to buy some form of insurance, whether it’s for the home, the car, or our lives. But you might be amazed to learn that most people make generally poor insurance buying decisions. And this is in part because we get so nervous when we are at the insurance agent’s office we miss important things. The first thing your insurance agent wants you to know is that almost nothing is carved in stone. You can make changes to your insurance polices as your needs and circumstances change. Your agent is there to help you do that. Many families struggle to pay expensive insurance premiums when their…

-

Making Money at the Flea Market

Have you ever visited a flea market? Time was they could be found just about everywhere. Now it seems like most of the old ones are vanishing fast. Flea markets were great places for people to sell of unwanted stuff and to look for things they missed buying in the stores. But naturally there was a lot of junk at the flea markets that no one wanted. Flea market retailing was once a way of life for thousands of small vendors across North America. It remains a way of life for hundreds of thousands of small vendors across the world, perhaps more than a million. If you can procure a…